Why Filing an Online Tax Return in Australia Is the Fastest Means to Get Your Refund

Why Filing an Online Tax Return in Australia Is the Fastest Means to Get Your Refund

Blog Article

Navigate Your Online Tax Return in Australia: Important Resources and Tips

Navigating the on-line tax return procedure in Australia needs a clear understanding of your obligations and the sources available to simplify the experience. Vital documents, such as your Tax Obligation File Number and revenue statements, must be thoroughly prepared. Selecting an ideal online platform can dramatically affect the efficiency of your declaring procedure.

Comprehending Tax Obligation Obligations

Comprehending tax obligation responsibilities is essential for individuals and businesses running in Australia. The Australian taxation system is controlled by various regulations and laws that call for taxpayers to be familiar with their obligations. People should report their earnings accurately, that includes incomes, rental revenue, and financial investment incomes, and pay taxes as necessary. Furthermore, residents need to understand the difference between taxed and non-taxable revenue to make sure compliance and enhance tax obligation outcomes.

For organizations, tax obligation obligations include several facets, including the Item and Provider Tax Obligation (GST), business tax, and payroll tax. It is crucial for companies to sign up for an Australian Organization Number (ABN) and, if applicable, GST registration. These duties require thorough record-keeping and timely entries of tax obligation returns.

In addition, taxpayers should recognize with offered deductions and offsets that can relieve their tax obligation concern. Looking for advice from tax obligation specialists can supply beneficial insights into optimizing tax obligation placements while making sure compliance with the regulation. In general, a thorough understanding of tax commitments is crucial for effective financial planning and to prevent charges associated with non-compliance in Australia.

Essential Files to Prepare

Furthermore, put together any pertinent financial institution declarations that mirror passion earnings, in addition to returns statements if you hold shares. If you have various other income sources, such as rental residential properties or freelance job, guarantee you have records of these revenues and any kind of associated costs.

Don't forget to include deductions for which you may be eligible. This could include invoices for job-related expenses, education costs, or charitable donations. Take into consideration any type of exclusive health insurance policy declarations, as these can impact your tax obligation commitments. By collecting these important records in breakthrough, you will enhance your on the internet tax return procedure, minimize mistakes, and make best use of possible reimbursements.

Choosing the Right Online System

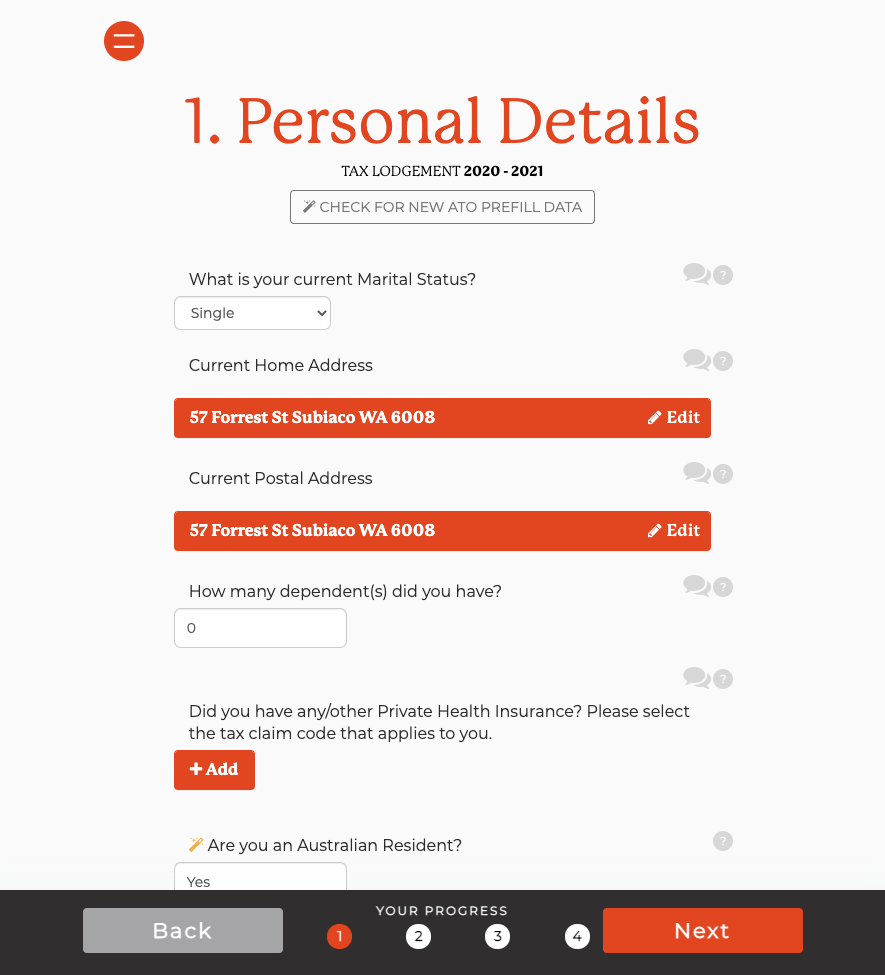

As you prepare to submit your online tax return in Australia, choosing the appropriate platform is essential to make certain accuracy and ease of use. A simple, user-friendly design can considerably boost your experience, making it much easier to browse complex tax obligation forms.

Next, examine the platform's compatibility with your monetary scenario. Some services provide particularly to people with easy tax obligation returns, while others supply extensive assistance for much more complex circumstances, such as self-employment or investment earnings. Additionally, search for systems that offer real-time mistake checking and support, aiding to decrease mistakes and ensuring compliance with Australian tax legislations.

An additional vital facet to take into consideration is the level of consumer support readily available. Reputable platforms need to offer accessibility to aid by means of email, phone, or chat, particularly throughout height filing durations. Furthermore, research customer testimonials and rankings to gauge the general contentment and reliability of the platform.

Tips for a Smooth Filing Process

Submitting your on-line tax return can be a straightforward procedure if you adhere to a couple of key tips to make certain effectiveness and accuracy. Gather all essential documents prior to starting. This includes your earnings declarations, receipts for reductions, and any kind of other relevant documentation. Having every little thing at hand minimizes mistakes and disturbances.

Following, make use of the pre-filling function supplied by lots of online platforms. This can save time and decrease the possibility of mistakes by automatically populating your return with information from previous years and data provided by your company and monetary institutions.

Additionally, double-check all entrances for accuracy. online tax return in Australia. Mistakes can bring about postponed refunds or concerns with the Australian Taxes Workplace (ATO) Make certain that your personal information, earnings numbers, and deductions are proper

Filing early not only lowers anxiety however additionally allows for much better planning if you owe taxes. By following these suggestions, you can browse the online tax obligation return procedure smoothly and with confidence.

Resources for Support and Support

Navigating the intricacies of on the internet tax returns can occasionally be daunting, yet a range of sources for aid and assistance are conveniently available to assist taxpayers. The Australian Taxation Workplace (ATO) is the primary source of information, using comprehensive overviews on its website, including FAQs, educational videos, and live conversation options for real-time support.

In Addition, the ATO's phone assistance line is available for those who favor pop over here direct interaction. online tax return in Australia. Tax professionals, such as licensed tax agents, can additionally supply tailored support and guarantee conformity with present tax policies

Final Thought

In final thought, effectively navigating the on-line income tax return process in Australia calls for a complete understanding of tax obligations, precise prep work of essential papers, and careful choice of an appropriate online platform. Complying with useful suggestions can improve the filing experience, while offered sources supply beneficial support. By approaching the process with persistance and focus to information, taxpayers can make sure compliance and maximize possible benefits, eventually adding to an extra reliable and successful tax obligation return outcome.

As you prepare to submit your on-line tax obligation return in Australia, selecting the browse around this site appropriate system is necessary to make sure accuracy and ease of use.In conclusion, efficiently navigating the online tax return process in Australia requires a detailed understanding of tax obligation commitments, precise preparation of necessary papers, and cautious choice of a proper online platform.

Report this page